Automating the going concern assessment

By Lotte Verhoeven, Eric Mantelaers and Martijn Zoet

NOTE: This article is based on the bachelor thesis of Lotte Verhoeven and the paper ‘Towards a Going Concern Assessment Pipeline’ from the eKNOW 2022 conference.

The going concern assessment is currently heavily debated all over the world. This within the larger context of the current societal debate on audit quality. With cases such as Imtech and Steinhoff proving that going concern assessments needs to be a viable part of the audit. In our research we aimed to answer the main question: “How can machine learning be used to assess the organizational going concern assessment?”

Inhoudsopgave

Introduction – Going Concern Assessment

Research shows that the going concern assessment is one of the most important challenges within the decision-making process of companies [1]. Title 9, Book 2 of the Dutch Civil Code lays down the legal rules with respect of the financial statements and the management report. The law stipulates that the management should value the assets and liabilities under the going concern assumption, unless serious doubts concerning the continuity exists (2:384 paragraph 3 of the Dutch Civil Code). When drawing up financial statements, the going concern assumption is therefore leading. The auditor assesses this going concern assumption in both statutory and voluntary audit engagements, but also in review engagements and compilation engagements [2]. The corresponding rules are laid down in ISA-2400 & NV COS 2400 and ISA-4410 & NV COS 4410 respectively [3][4].

Past experience shows that, despite the fact that an unqualified audit opinion has been issued, organizations can still go bankrupt in the foreseeable future. An example of this is the inadequately evaluated going concern assessment of Imtech in 2012 [5] or the unseen irregularities within Steinhoff in 2017 [6]. In the latter case the auditor was accused by the Dutch Authority for Financial Markets (AFM) of not obtaining sufficient and appropriate audit evidence to identify the fraud [6]. In addition, the auditor’s unconscious biases, caused by among other things client relations and confidentiality, do not contribute to an independent going concern assessment [7].

Method – Forecasting algorithms

The going concern assessment is still largely dependent on the professional judgement of the auditor, who must assess whether management has made proper considerations. Research shows that technology can contribute to an improvement of audit quality [8]. By automating the going concern assessment, more time and resources can be allocated to the interpretation of the going concern analysis. This maximizes the dual aspects of audit quality: independence and expertise [8][9].

To support the individual and personal professional judgment of the auditor an additional automated going concern assessment, a more direct source of information with possibly higher reliability could provide a solution. Automated forecasting of figures and numbers is possible with the use of forecasting algorithms. An algorithm is an instruction in the form of code that can be used, among other things, for forecasting time series [10]. Similar to previous research we apply PyCaret to test multiple algorithms in concurrence [11][12].The use of PyCaret leads to an automated going concern analysis that is less dependent on the individual and personal professional judgment of the auditor, thus a possible improvement of uniformity can be realized.

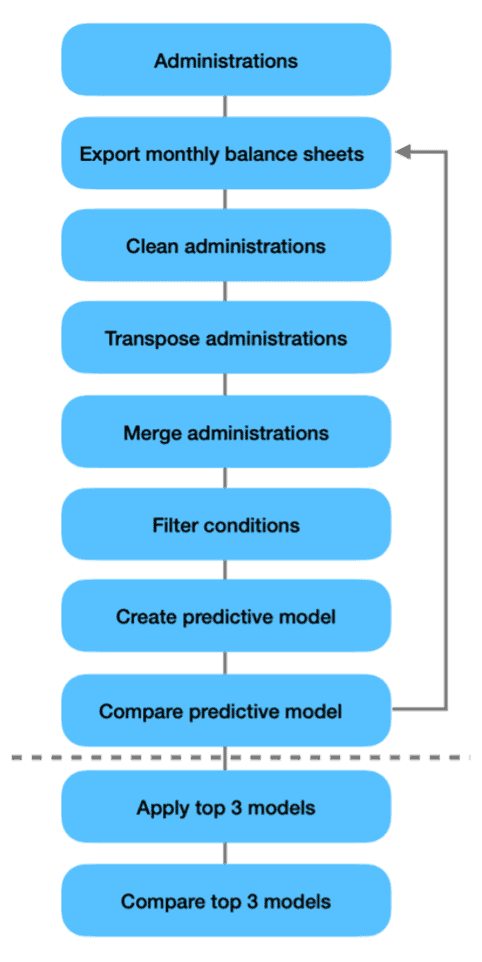

To obtain the source data, the existing period balances were exported from Exact Online for eight to thirteen years, depending on the administration and availability. After cleaning and merging the data, the individual conditions (e.g., current liabilities, equity, sales, etc.) were filtered, leading to a dataset per administration per condition per month. In which the word conditions refers to the various data points that can be used to assess the going concern of an organization.

The dataset per administration per condition per month for the available years, is then presented to PyCaret’s regression module (v 2.3.2). The regression module is a supervised machine learning module used for estimating the relationship between a dependent variable and independent variables. PyCaret uses different mathematical models translated into similarly named forecasting algorithms to see which model makes the best predictions. Each forecasting algorithm is tailored to specific situations, such as seasonal data. In addition, each forecasting algorithm works with its own assumptions and interpretations, resulting in different forecasts [10]. By comparing these predictions with each other and the actual realized figures, a complete picture is generated.

In doing so, each forecasting algorithm works with its own assumptions and interpretations, resulting in different forecasts. The model that best fits the administration is shown at the top and the model with the least fit is shown at the bottom. The predictions and the true value of the top three are then stored in one file and compared. To assess the accuracy of the predictions, the (percentual) deviations per month and at the total level were calculated from these real figures. The overall structure of the used algorithms in shown in figure 1.

Results

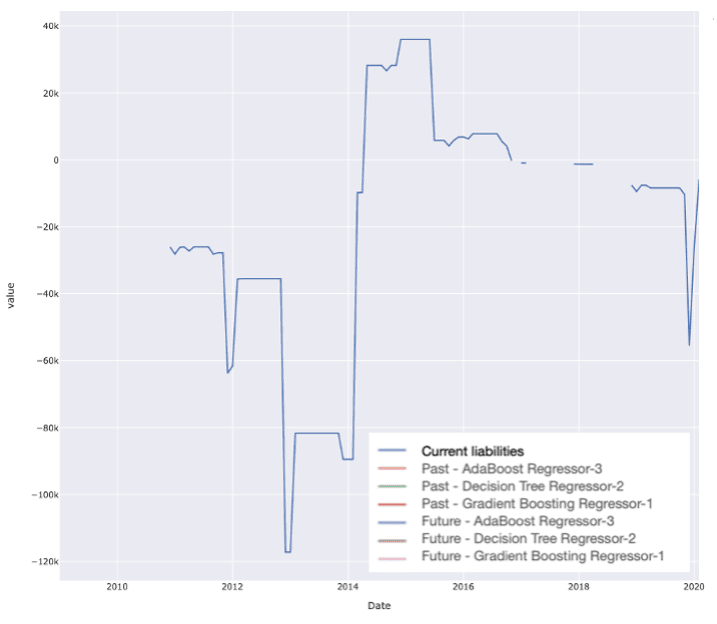

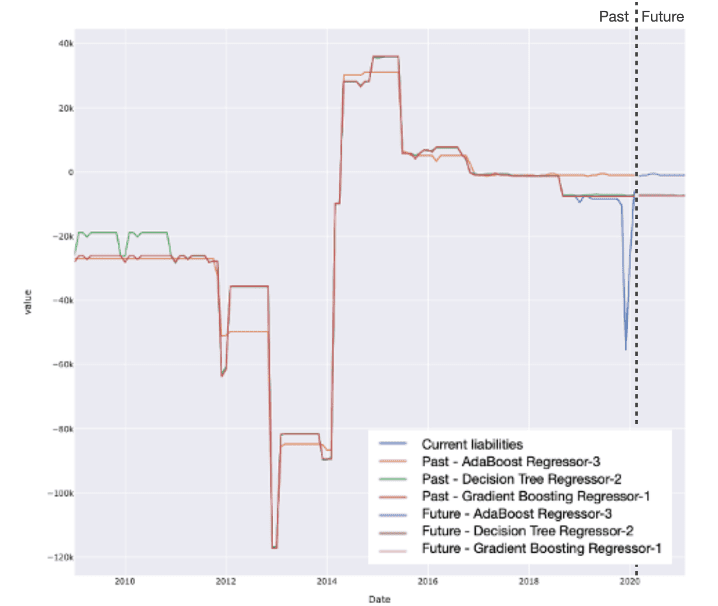

For the condition current liabilities from Administration 1, the results are explained below. Using PyCaret’s regression module, the Gradient Boosting Regressor, Decision Tree Regressor and the AdaBoost Regressor models emerge as the most accurate. The actual current liabilities figures from Administration 1 are represented in Figure 2.

The results of the top three models are then added in Figure 3, where the blue line represents the actual short-term debt figures, and the other colored lines represent the predictions. The forecasts within PyCaret consist of two parts per model: Past and Future. Past predicts back into the past based on an adaptive training set consisting out of several years after the predicted year. Future predicts a predetermined time period (in this case six months) based on actual historical figures.

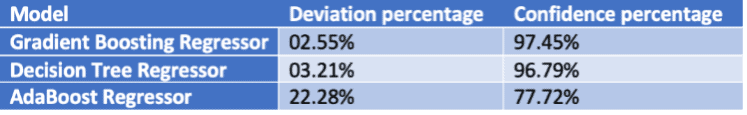

In addition, the results of the different forecasting algorithms for the current liabilities of Administration 1 were then merged into one CSV file. In addition, the (percentage) deviations were calculated based on the actual figures. In this way, the forecasts are compared with the actual figures. For example, for the period 2010-12-11, the deviation between the AdaBoost Regressor model and the actual value of the current liabilities is € 911, which represents a deviation of 3.5%. The results for the current liabilities of Administration 1 are visually shown in Table 1.

On average, a deviation percentage of 2.55% for the Gradient Boosting Regressor model, 3.21% for the Decision Tree Regressor model and 22.28% for the AdaBoost Regressor model was achieved for short-term debt. This leads to a confidence percentage of 97.45%, 96.79% and 77.72%, respectively.

Discussion, Conclusion & Future research

This research presents a first step towards an automated process of going concern assessment. The goal of this research was to predict the different individual variables that affect the going concern assessment of the auditor. A confidence percentage of 97.45% for the Gradient Boosting Regressor model, 96.79% for the Decision Tree Regressor model and 77.72% for the AdaBoost Regressor model was measured on the basis of the current liabilities for Administration 1. This means that the predictions of the algorithms are reliable with 97.45% for the Gradient Boosting Regressor model. The results therefore show that individual variables can be predicted with the various algorithms of the PyCaret Library. This means that the machine learning used in this paper, particularly PyCaret, can be used to assess the organizational going concern assessment.

The insights derived from our study provide a better understanding of the ability to predict individual conditions. This means that the Altman Z-score as a whole can be predicted, resulting in a predictive continuity. Future research should focus on creating an indicator of the going concern assessment. In our study, we draw our conclusions based upon data collected solely from the Dutch context, which limits, in terms of sampling, a broader generalization towards non-Dutch organizations. Future research should focus on further generalization towards other countries. In addition, the sample only consisted of small and medium sized organizations, future research should focus on further generalization towards other industries (non-governmental). Related to the previous limitation is the sample size, which is limited to 225 organizations. Although this is a rather large sample size, the total number of organizations in the Netherlands is much larger. In addition, the predictions are now based on a single variable. For future research, multivariable predictions can be applied to see if this will increase the predictive value. Future research should also focus on comparing the forecast with the going concern paragraphs (used or not) in the financial statements concerned. In this way, it can be determined whether or not there is uncertainty about continuity, or in the accounting policies or events after the balance sheet date, and whether this matches the results of the algorithms.

Authors

- Lotte M.G. Verhoeven BSc – Lotte is working at RSM Netherlands Accountants N.V., as well at the Research Centre ‘Future-proof Auditor’ at Zuyd University of Applied Sciences. After completing her bachelor Accountancy at Zuyd University of Applied Sciences, Lotte has now started her master’s degree in Accounting and Control at Maastricht University.

- Eric J.H.J. Mantelaers RA AA CISA C|CISO is a Professor of Applied Sciences at the Research Centre ‘Future-proof Auditor’ of Zuyd University of Applied Sciences. In addition, Eric Mantelaers is Head of the Department of the Professional Practice Department of RSM Netherlands Accountants N.V.

- Ing. Martijn M. Zoet is a Professor of Applied Sciences at the Research Centre ‘Future-proof Financial’ of Zuyd University of Applied Sciences. In addition, Martijn Zoet is managing partner of EDM-Competence Centre.

lotte.verhoeven@zuyd.nl

Acknowledgements

The authors are grateful to RSM Netherlands Accountants N.V. for cooperating within this research project, as well as for making the dataset available.

References

[1] D. E. O’Leary and R. M. O’Keefe, “The Impact of Artificial Intelligence in Accounting Work: Expert Systems Use in Auditing and Tax,” AI Soc., vol. 11, no. 1–2, pp. 36–47, 1997, doi: 10.1007/BF02812437.

[2] E. van der Velden, “Going concern and compilation engagements,” Account., no. 7/8, pp. 34–35, 2012.

[3] International Auditing and Assurance Standards Board, Handbook of International Quality Control, Auditing, Review, Other Assurance and Related Services Pronouncements, vol. II. 2020.

[4] NBA, “HRA,” in Regulations Manual Accountancy(HRA), 2022.

[5] M. J. G. Princen and M. P. J. Peters, “Ruling of the court dated January 15, 2021 pursuant to Section 38 of the Accountants Disciplinary Act (Wtra) in the complaints received on July 17, 2018 with numbers 18/1193 and 18/1194 Wtra AK,” Jan. 15, 2021. https://repository.overheid.nl/frbr/tuchtrecht/2021/ECLI:NL:TACAKN:2021:2/1/pdf/ECLI_NL_TACAKN_2021_2.pdf (accessed Jun. 06, 2022).

[6] Bloomberg, “Ex-deloitte Auditor Faces Disciplinary Action over Steinhoff,” 2021. https://www.bloomberg.com/news/articles/2021-04-22/ex-deloitte-auditor-faces-disciplinary-action-over-steinhoff#xj4y7vzkg (accessed Jun. 06, 2022).

[7] D. Bazerman, M.H.; Loewenstein, G.; Moore, “Why Good Accountants Do Bad Audits,” Harvard Business Review, vol. 97. 2002.

[8] E. Mantelaers, “An Evaluation of Technologies to Improve Auditing,” Open Universiteit, 2021.

[9] L. E. DeAngelo, “Auditor Size and Audit Quality,” J. Account. Econ., vol. 3, no. 3, pp. 183–199, 1981, doi: https://doi.org/10.1016/0165-4101(81)90002-1.

[10] PyCaret, “PyCaret,” 2021. https://pycaret.gitbook.io/docs/ (accessed Jun. 06, 2022).

[11] R. Abdullah, Iqbal, F.B.; Biswas, S.; Urba, “Performance Analysis of Intrusion Detection Systems Using the PyCaret Machine Learning Library on the UNSW-NB15 Dataset,” Brac University, 2021.

[12] D. T. U. Pol, Dr. U.R.; Sawant, “Automl: Building An Classification Model With PyCaret,” YMER, vol. 20, no. 11, pp. 547–552, 2021.